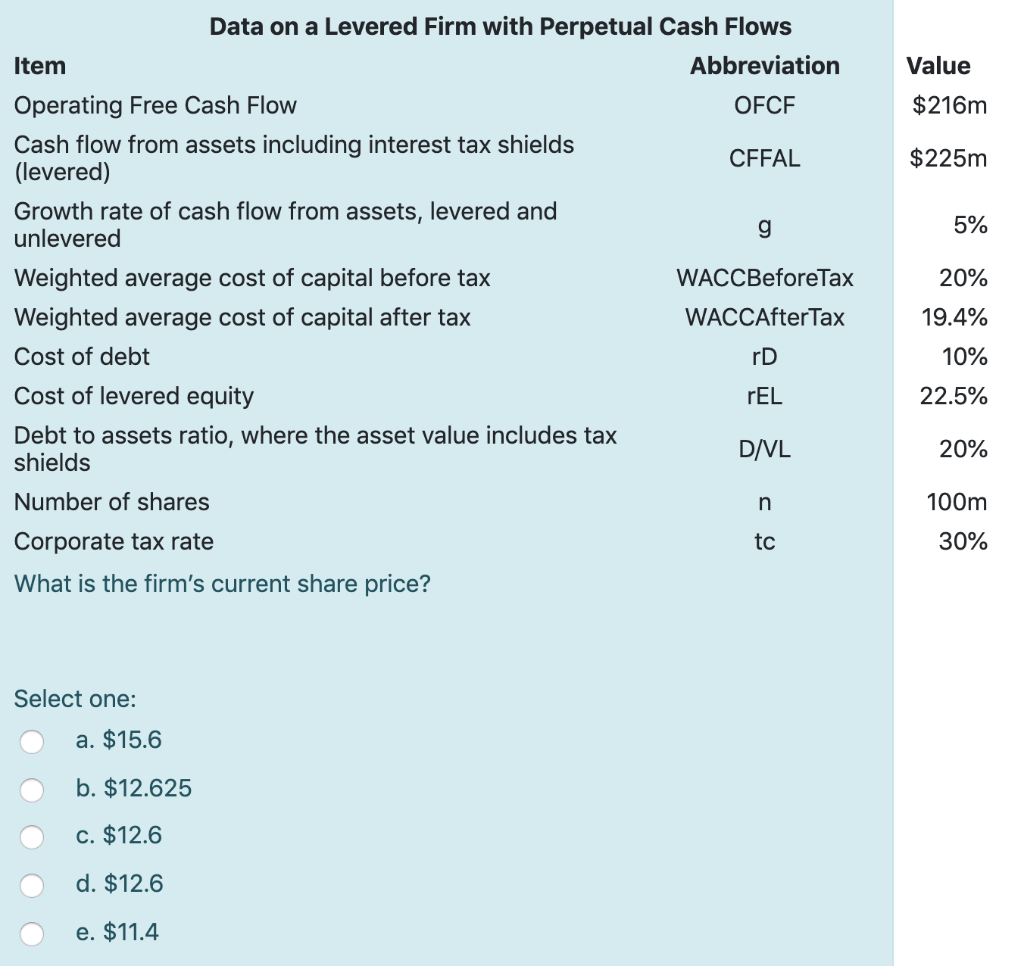

interest tax shield fcff

The effect of a tax shield can be determined using a formula. Free cash flow for the firm FCFF is a measure of financial performance that expresses the net amount of cash that is generated for a.

Part 1 Kasperov Corporation Has An Unlevered Cost Of Chegg Com

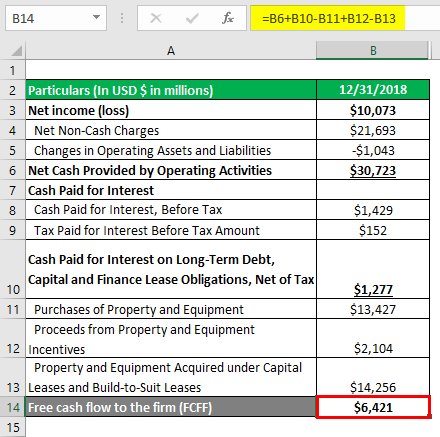

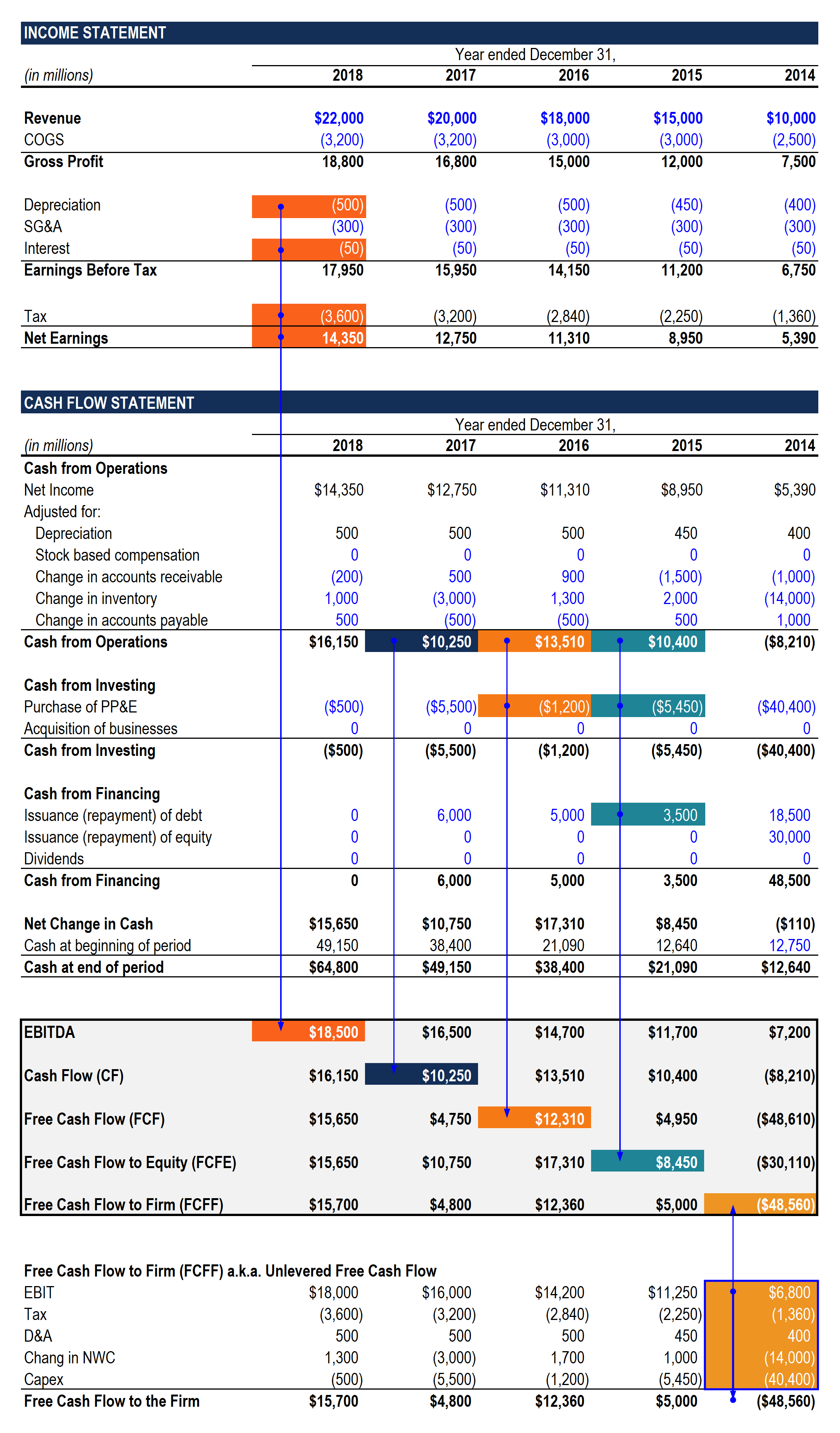

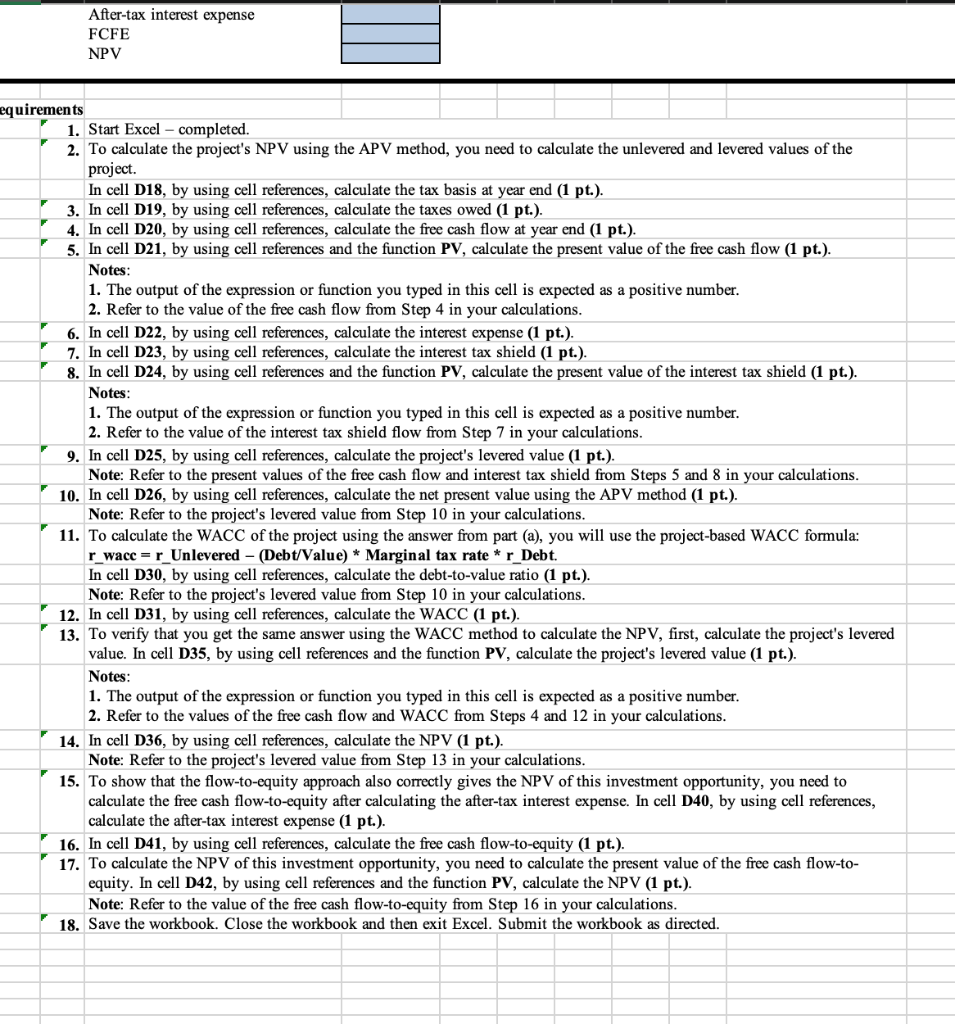

FCFF Net income Non-cash charges Interests1-tax rate - fixed capital investments - working capital investments I just wanna focus in.

. This is equivalent to the. This companys tax savings is equivalent to the interest payment multiplied by the tax rate. - Capex - WC.

The tax shield is the amount saved in taxes by paying interest. Include the tax shield benefit back in FCFD Free. However here in FCF formula we dont account the.

Hi Friends FCF EBIT1-Tc Depr. Starting from net income the following simplified calculation procedure is then applied. My understanding is that interest expense impacts the tax amount.

They recognize the underlying expenses while calculating net cash Net Cash Net Cash represent the companys liquidity. In almost all books the free cash flow is adjusted for the effect of the tax shield. FCFF includes an interest tax shield as opposed to FCFE.

They think tax shield which is interest expenses tax rate should be added back to calculate FCFF because most companies deduct interest expenses in calculating. As such the shield is 8000000 x 10 x 35 280000. So when you add back.

To do that Interest with tax shield Interest 1 tax 701-25 525. As we can see this appears even further up on the income statement as compared to the EBIT number. If you dont want to add tax.

So interest that we add back should be factored in for tax shield. Start with Earnings Before Interest and Tax EBIT Calculate the hypothetical tax bill the company would have if. However students usually get confused by the absence of the ctax shield.

Thats because you use tax adjusted WACC for discounting FCF. Wacc weighted average cost of equity and tax adjusted cost of debt. Answer 1 of 5.

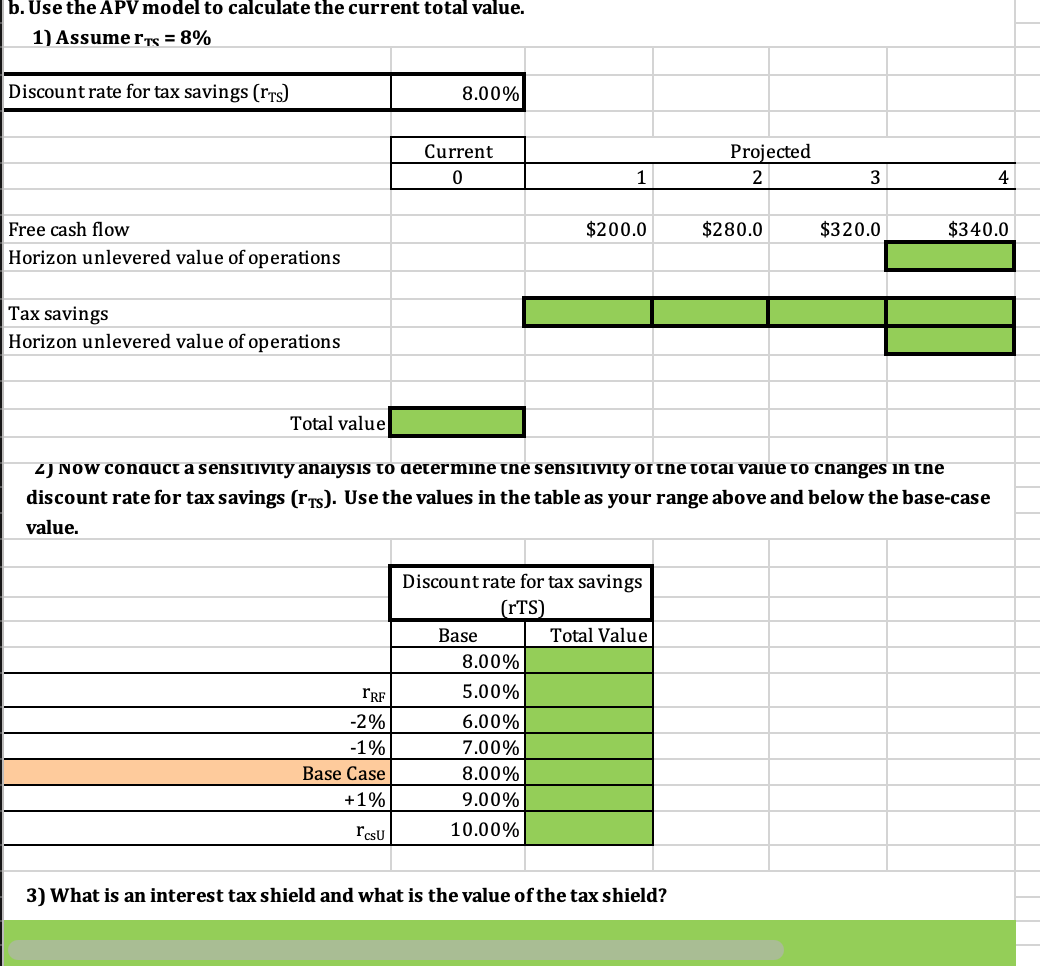

Free Cash Flow For The Firm - FCFF. Here is a step-by-step breakdown of how to calculate FCFF. An interest tax shield is defined as.

FCFF is calculated using the formula given below. EBITDA stands for Earnings before interest tax depreciation and amortization.

Solved 1 Western Lumber Company Expects To Have Free Cash Flow In The Coming Year Of 4 25m And Its Free Cash Flow Is Expected To Grow At A Rate O Course Hero

Doc Free Cash Flow Valuation Narendra Jha Academia Edu

Free Cash Flow To Firm Fcff Formula And Calculation

Financecore Tax Shields Explained Youtube

Interest Tax Shield Formula And Calculation

2023 Cfa Level Ii Exam Cfa Exam Practice Question

Free Cash Flow Yield Formula And Calculation

Tax Shield Formula How To Calculate Tax Shield With Example

Free Cash Flow From Ebitda How To Calculate

Free Cash Flow Yield Formula And Calculation

Fcff Formula Examples Of Fcff With Excel Template

Why Are Tax Savings From Interest Ignored When Computing Free Cash Flow To Firm

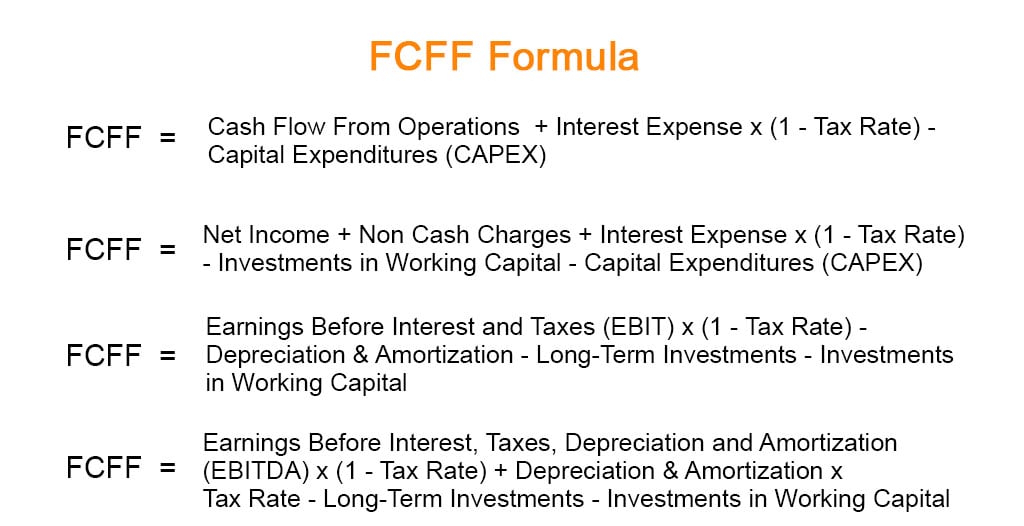

Value 216m 225m 5 20 Data On A Levered Firm With Chegg Com

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff

:max_bytes(150000):strip_icc()/dotdash-INV-final-Trailing-FCF-May-2021-02-afb91b9ed3da46bb93c868093e42d108.jpg)

Trailing Free Cash Flow Fcf Definition

You Are Evaluating A Project That Requires An Chegg Com

Free Cash Flow And Other Valuation Models Los 31 34 Flashcards Quizlet