does instacart take taxes out of paycheck

Instacart shoppers are paid a minimum amount for every batch or order they complete. For most Shipt and Instacart shoppers you get a.

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

Since in-store shoppers are traditional part-time employees Instacart handles withholding money for taxes.

. Just go through the interview and answer the questions. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year. Since in-store shoppers are traditional part-time employees Instacart handles.

Knowing how much to pay is just the first step. Does Instacart take taxes out. Does Instacart take taxes out.

Yes even as an independent contractor you are to report your earnings from working as an independent contractor at a 3rd party delivery driver Instacart UberEats. Part-time employees sign an. For its part-time shoppers Instacart doesnt take out taxes and they file W-2s.

If you lose your. You can find this in your shopper account or keep records in your own bookkeeping app. If you made over 600 and you did not receive a 1099 contact Instacarts Shopper support right away.

There will be a clear indication. Everyone out there serving for. Instacart does take out taxes if you are an in-store shopper but do not worry if you are a full-time instacart shopper there is no tax for them.

Instacarts official name is Instacart other delivery companies use different legal names. Both employee and employer shares in paying these taxes. What Taxes Do Instacart Shoppers Need to Pay.

However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022. Answer 1 of 4. What Taxes Do Instacart Shoppers Need to Pay.

Please make any changes by January 15 and reach out to. To actually file your Instacart taxes youll need the right tax form. Instacart delivery starts at 399 for same-day orders over 35.

The first step of the Instacart shopper taxes is to calculate your estimated taxes and proactively pay estimatedincome taxes on a quarterly basis. But Instacart pays its in-store shoppers a base pay of 10 per hour plus commission through the. But Instacart pays its in-store shoppers a base pay of 10 per hour plus.

Fees vary for one-hour deliveries club store deliveries and deliveries under 35. This amount was previously 3 but after a PR snafu when. However you still have to file an income tax return.

A total of 153 124 for social security and 29 for Medicare is applied to an employees gross compensation. These rates include all your vehicles operational expenditures. Self Employment tax Scheduled SE is automatically generated if a person has.

The Instacart 1099 tax forms youll need to file. View all 987 questions about Instacart. Minimum Batch Payment.

Then you will enter your expenses.

How Self Employment Tax Works For Delivery Drivers In The Gig Economy

Calculating Federal Taxes And Take Home Pay Video Khan Academy

What You Need To Know About Instacart 1099 Taxes

Is Instacart Worth It Ultimate 2022 Guide How Much Can You Make

How To Become An Instacart Shopper Pros Cons Pay Job Application

Instacart Taxes The Ultimate Tax Guide For Instacart Shoppers Ageras

The Ultimate Guide To Self Employed Taxes Everlance

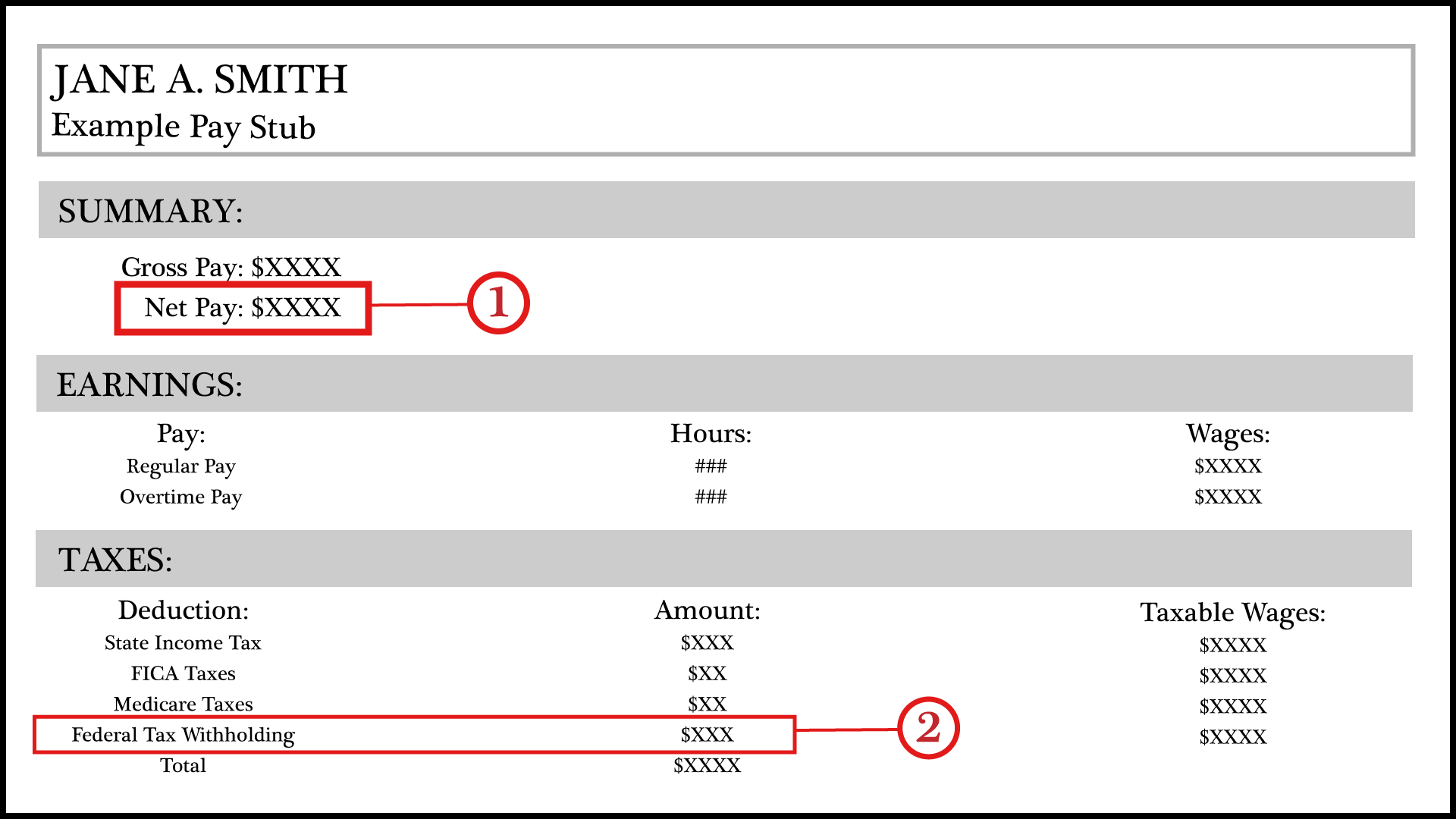

Explaining Paychecks To Your Employees

What You Need To Know About Instacart Taxes Net Pay Advance

When Does Instacart Pay Me A Contracted Employee S Guide

Paycheck Taxes Federal State Local Withholding H R Block

How To Handle Taxes For Your Side Hustle

What You Need To Know About Instacart 1099 Taxes

Instacart Taxes How Taxes Work For Instacart Shoppers 1099 Cafe

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Summer Jobs For Teens Come With Tax Traps And Benefits Wsj

What You Need To Know About Instacart Taxes Net Pay Advance